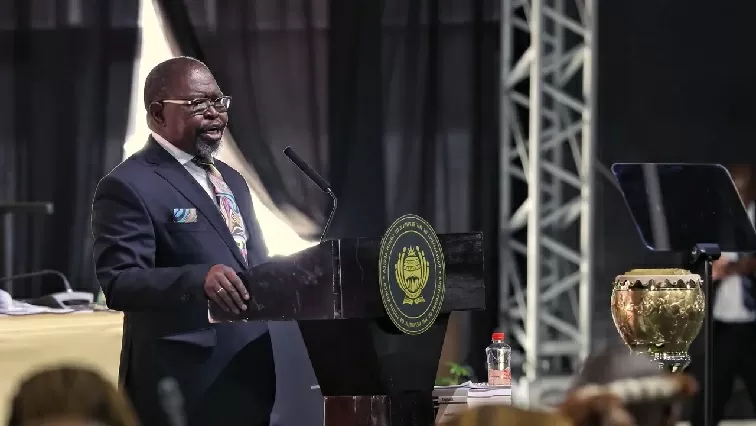

Julius Malema, the leader of the Economic Freedom Fighters (EFF), has recently made a bold statement regarding the recent VAT hike in South Africa. In a press conference, Malema stated that Finance Minister Enoch Godongwana does not have the power to reverse the VAT increase, which has caused a stir among the public.

The hike in VAT, from 15% to 16%, was announced by Godongwana in his Medium-Term Budget Policy Statement in October. This decision has been met with widespread criticism and backlash from citizens, who are already struggling with the economic impact of the COVID-19 pandemic.

Malema, known for his strong stance on social and economic issues, has been a vocal opponent of the VAT hike. In his statement, he asserted that the Finance Minister does not have the legal authority to reverse the increase, as it was implemented by the previous Finance Minister, Tito Mboweni.

He further explained that according to the Value-Added Tax Act, only the previous Minister who implemented the increase has the power to reverse it. Malema also accused Godongwana of being out of touch with the economic realities faced by the majority of South Africans.

This statement by Malema has sparked a debate among politicians and economists, with some agreeing with his stance while others argue that the Finance Minister does have the power to reverse the VAT hike.

However, one thing is certain – the VAT increase has had a significant impact on the lives of ordinary citizens. The cost of living has become even more burdensome, with basic necessities becoming more expensive. This has put a strain on the already struggling middle and lower-income families, who are now forced to tighten their belts even further.

The EFF has been a strong advocate for the reversal of the VAT hike, with Malema calling it a “regressive tax” that disproportionately affects the poor. He has also proposed alternative ways for the government to generate revenue, such as increasing taxes for the wealthy and implementing a wealth tax.

While the debate on whether the Finance Minister has the power to reverse the VAT increase continues, it is clear that the public is growing increasingly frustrated with the government’s handling of the economy. The pandemic has exposed the deep-rooted inequalities in our society, and the VAT hike only adds to the burden faced by the most vulnerable.

It is time for the government to listen to the voices of its citizens and take decisive action to alleviate their financial struggles. The VAT increase must be reversed, and alternative solutions must be explored to ensure a fair and just tax system.

Malema’s statement serves as a reminder to the government that they are accountable to the people and that their decisions have a direct impact on the lives of South Africans. It is encouraging to see opposition leaders like Malema speaking out on behalf of the citizens and holding the government accountable for their actions.

In the midst of the economic challenges faced by the country, it is important to have strong and vocal leaders like Malema who are not afraid to speak truth to power. His statement has sparked a much-needed conversation on the VAT hike and has brought the issue to the forefront of public discourse.

In conclusion, Julius Malema’s statement on the Finance Minister’s lack of power to reverse the VAT hike has shed light on an important issue that affects every South African. It is time for the government to listen to the concerns of its citizens and take action to alleviate their financial burden. The VAT increase must be reversed, and alternative solutions must be explored to create a fair and just tax system. Let us hope that our leaders will take heed of Malema’s words and work towards creating a more equitable and prosperous South Africa for all.